Posted by Pam Hoddinott

Posted by Pam Hoddinott People will remember 2022 as the inflection point for electric mobility in the United States. Over the past year, the U.S. became the latest country to surpass the critical EV tipping point of 5% of new car sales. Those tracking EV growth trends in Europe and China can see that 5% of recent car sales represents the bottom of the S-curve or when early adopters are overtaken by mainstream demand. Another notable notch in 2022’s belt came from the government’s historic investment in clean energy technology. The Bipartisan Infrastructure Law and the Inflation Reduction Act commit billions of dollars to zero-emissions transportation. Finally, corporate announcements abounded. Auto manufacturers unveiled plans to invest tens of billions of dollars to retool their factories and deliver new electric models to the market, and in some cases, phase out ICE sales altogether.

If 2022 marked the year of the electric vehicle, then 2023 will be the year of infrastructure. Electric transportation of people and freight presents a new refueling challenge that must be overcome. While there is much to be done to improve the ownership experience for passenger EV drivers, private and for-hire fleet operators face unique obstacles to fleet electrification.

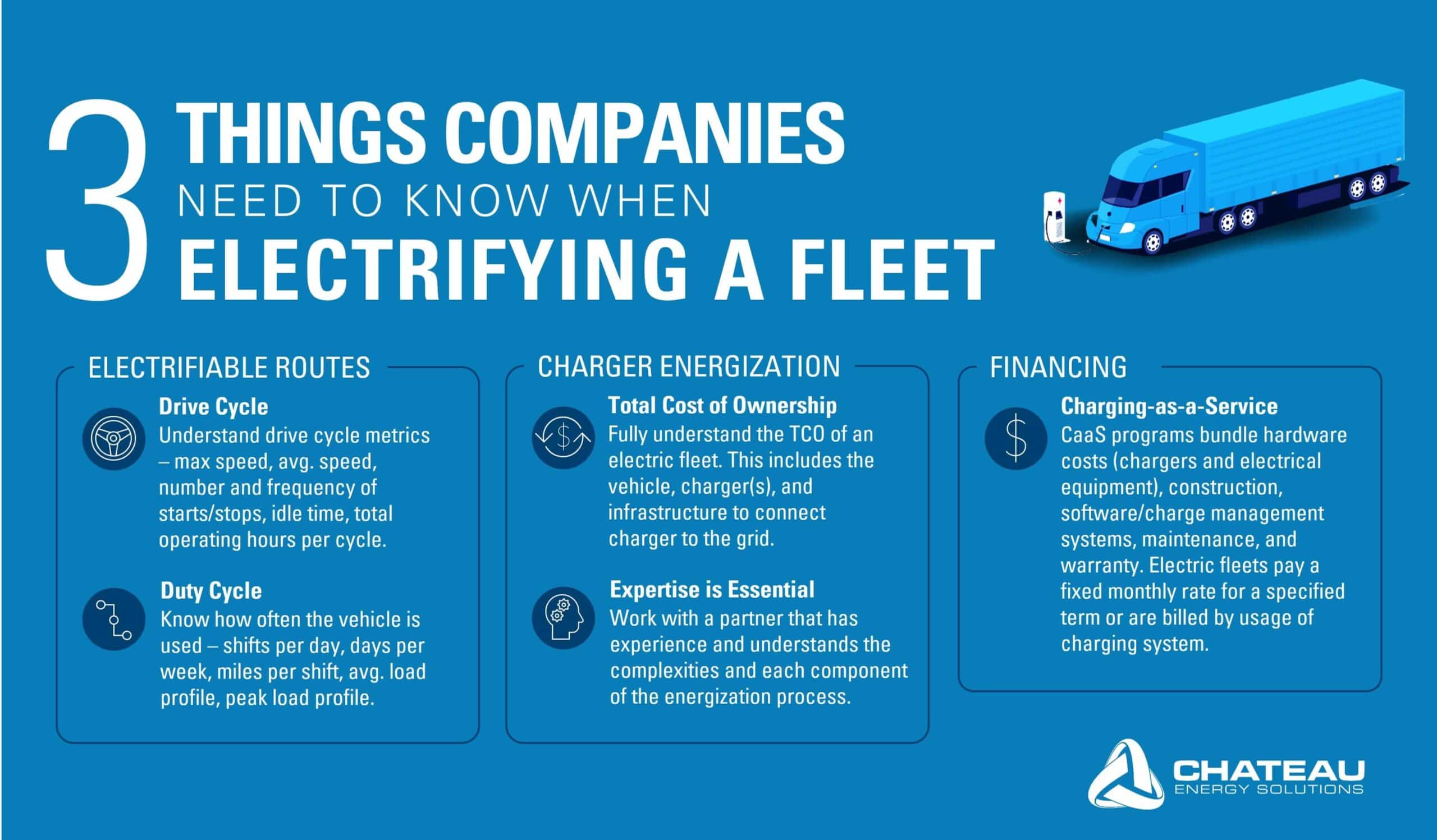

While there are some universal considerations when moving to an EV fleet, it is also essential to recognize your fleet’s unique needs and how to smartly, smoothly, and successfully transition. Here are three things fleet operators need to understand before electrifying their fleet:

The number of routes that cannot be served by electric vehicles is dwindling. Medium- and heavy-duty vehicle OEMs have introduced more, albeit slow to deliver, vehicle models ranging from Class 2b to 8. In model year 2023, there are a total of 115 medium- and heavy-duty electric vehicles available.

For fleets, the first step in any electrification roadmap is understanding the drive cycle and duty cycle of their vehicles. The Drive Cycle refers to how a vehicle is used. Metrics like maximum speed, average speed, number and frequency of vehicle starts and stops, idle time, and total operating hours per cycle define a vehicle’s drive cycle. The Duty Cycle refers to how much a vehicle is used. Factors including shifts per day, days per week, miles per shift, average load profile, and peak load profile make up a vehicle’s duty cycle.

Once the drive and duty cycle of the fleet is established, operators can begin identifying and evaluating vehicle models that fit their needs. Vehicle range, charging requirements, warranty coverage, and maintenance schedules should be considered when selecting battery-electric vehicles.

Electric vehicles offer fleet operators efficiencies that internal combustion engine (ICE) vehicles do not. The most commonly discussed upsides to electric drivetrains are reduced vehicle maintenance and lower fueling costs. However, these surface-level discussions fail to address additional costs and complexities that accompany an EV purchase.

While we do not think about it when we pump our gas, the cost of the gasoline transmission infrastructure is included in the cost per gallon at the pump. When Henry Ford democratized access to cars in the early 1900s, he also started a wave of expansion in the mid-and downstream oil and gas infrastructure industry. Gas stations emerged in population centers and along transportation corridors across the globe.

Similarly, the advent of the electric vehicle has prompted a nationwide expansion of the electric grid. Companies interested in fleet electrification must understand the Total Cost of Ownership (TCO) of an EV. TCO includes the vehicle, the charger, and the infrastructure that connects the charger to the grid. Fleets will be successful in this transition if their infrastructure partner understands each component of the energization process, including the parties involved and the electrical equipment required.

Historically speaking, fuel costs have fallen on the income statement for private and for-hire fleets. Tanks are filled in en route to freight destinations. Today, this is not a reality for commercial electric vehicles. Technological limitations of the batteries on board prevent recharging times comparable to diesel refueling times.

Chargers and the infrastructure behind them can quickly spoil an exciting time for fleet managers. Trying to unpack the “How to” guides on the internet will likely leave fleet managers with more questions than answers. Engineering and battery technology aside, the most critical question to answer is, “How will our company pay for this?”

As with most things, there is no one-size-fits-all answer. However, understanding the solutions in the market puts you in the driver’s seat. Today, fleets that are in the pilot stage of their electrification journey primarily rely on their internal capital to deploy charging infrastructure at their facilities. While this approach is commendable, fleet managers quickly face the realities of expensive chargers, construction, and electrical upgrades.

EV charging infrastructure providers have responded to this challenge by offering Charging-as-a-Service (CaaS) programs. These solutions bundle the hardware costs of the chargers and electrical equipment, construction, software or charge management systems, and long-term maintenance and warranty programs. Fleets are then expected to pay a fixed monthly rate over a specified term or are billed by their usage of the charging system. It is critical for fleet managers to understand the pros and cons of alternative payment schedules like these. Overall, CaaS solutions can be an effective tool for reverting electric vehicle fuel costs from the balance sheet to the income statement.

The commercial electric vehicle market will continue to experience exponential growth in the coming years. Driven by federal and state incentives, total cost of ownership improvements, and corporate emissions reductions, cost-competitive vehicles will be made widely available by vehicle OEMs. In 2023, EV charging infrastructure developers across the country will need to pick up their shovels to deliver the charging capacity to keep pace. Electric vehicles are only as efficient as the power that’s delivered to them.

For all your fleet EV charging needs, work with an expert in the field – Chateau Energy. Our turn-key charging infrastructure solutions provide fleet operators with a customized strategy needed to transition to an EV fleet. We have assisted top U.S. fleets with their fleet electrification planning and programs. Chateau Energy’s mission is to deliver the most reliable charging infrastructure for the lowest TCO, ensuring our customers realize the greatest value from their electric fleet.

Michael Bresnahan plays an integral role in the growth of Chateau Energy Solutions’ EV Charging Infrastructure business unit. He enjoys building strong partnerships with customers, EVSE hardware manufacturers, commercial vehicle manufacturers, and other market participants. Previously, Michael has held roles at a financial services holding company, a real estate development firm, and the U.S. Development Finance Corporation. Michael graduated from Southern Methodist University with a Bachelor of Business Administration in Finance, with a Concentration in Energy Management. When he’s not helping clients better understand how to navigate the complex world of energy, he’s helping Little Leaguers locate the strike zone, playing golf, or rooting on Atlanta sports teams. Contact Michael on LinkedIn.

Chateau Energy Solutions Making Energy an Asset®

Ready to get started on the path to energy efficiency and sustainability?